If you are looking to buy in the next few months, there may be some GTA neighbourhoods that will experience a further price drop. Some neighbourhoods will increase in price. Toronto is transitioning from a wildly out of control housing market where it seemed like every listing was getting multiple offers, to a market with balance between buyers and sellers. This is a good thing. Consequently, what might be happening in one neighbourhood could be the exact opposite in another. How do you know which of the 450 GTA neighbourhoods to target?

What goes up (quickly), Must come down

The neighbourhoods that experienced the biggest increase in prices will experience the biggest decrease. A healthy real estate market has 5-7% price increases per year. If you can believe it, some neighbourhoods had 50% Year-over-year increases in prices, while others had 10-20% increases. The neighbourhoods with large price increases seemed like bargains at the time, because everything was expensive and going up in value. Some of it was fueled by speculators, and some of it was fueled by everyday people just wanting to get into the GTA housing market. It seemed like there was a false assumption that prices were going to continue to increase at 10-20% (or more) forever. It was like an out-of-control high school party. It was a lot of fun, but it’s only a matter of time before it ends… badly.

Furthermore, the neighbourhoods that are likely to have further price decreases are likely less desireable. Some questions to ask yourself include, “Is this property close to good amenities? What is the commute like to jobs? or Is it close to good schools?” These are the questions that people ask themselves in a balanced market.

Supply and Demand

If there are a lot of listings and they are not selling, it is a recipe for lower prices in the future. Sellers who need to sell, will lower their price far enough to entice a buyer to purchase their property. The seller who doesn’t need to sell, will take their property off of the market and wait. As a result, these neighbourhoods will continue to have lots of supply over the next few months as sellers continue to guess what their new lower market price should be. Avoid these neighbourhoods if you are sensitive to a further price drop in the next six to twelve months. Target these neighbourhoods if you’re looking for a deal and are looking to hold the property over the next five to ten years.

Tip: Make sure you have money set aside in case the property doesn’t appraise at the purchase price. The bank may ask for a larger down payment.

Neighbourhoods with low supply will not suddenly switch to having lots of supply. The neighbourhoods with great fundamentals like jobs, transportation, prestige, etc.will continue to be in demand over the long term and are much less sensitive to price decreases.

Months of Inventory

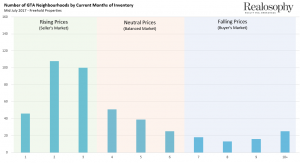

The chart below shows the number of neighbourhoods in the GTA based on their current months of inventory for freehold houses (detached, semi, row house and non-condo townhouses, etc.).

Number of GTA Neighbourhoods by Current Months of Inventory as of July 2017. Courtesy of Realosophy

Rule of Thumb: A healthy market with a balance between buyers and sellers has about four to six Months of Inventory. Accordingly, prices go up when there is less than four months and similarly prices go down when there are more than six months of inventory.

For reference, there was about one month of inventory before the mortgage regulation changes in the Spring of 2017 . The market was not healthy. Presumably most sellers were at a considerable advantage.

At the present time, there are 72 neighbourhoods in “falling prices” territory. For comparison, there are 253 neighbourhoods with “Rising Prices” and about 113 with “neutral prices”. Please refer to the chart from Realosophy.

Target Neighbourhoods

It is impossible to know the right move to make without expert advice. Stack your team with professionals that are familiar with your target neighbourhoods and the latest mortgage rules. Above all, it could save you time, money and heartache.

If you’d like, reach out to me to discuss your personal situation.

For more on this, please watch TVO’s The Agenda‘s episode with Toronto Star reporter Tess Kalinowski and realtor, John Pasalis. They discuss the province’s attempt to cool down the market and the what’s happening in the GTA housing market.